Clueless about purchasing the right two-wheeler insurance?

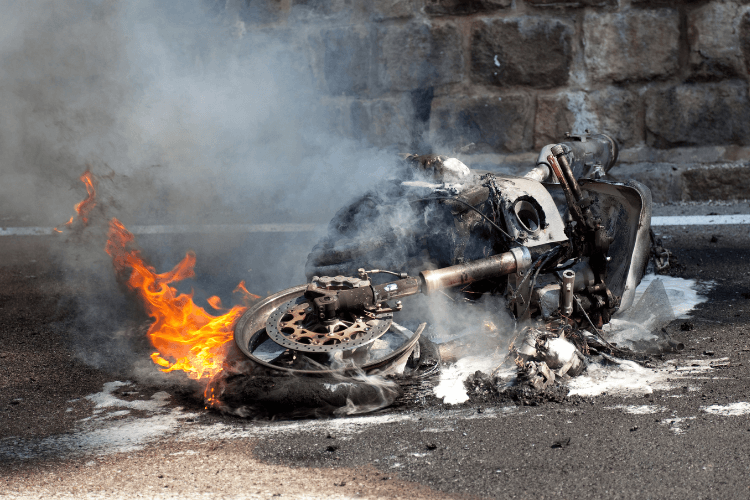

Every year, approximately ten million two-wheelers are bought in India. With poorly implemented traffic rules and potholes-filled bumpy roads, motor accidents are more likely to happen. In 2016 itself, two-wheeler accidents caused almost around 44,000 fatalities.

Hence, as per the Motor Vehicles Act 1988, the Indian government has made it mandatory for two-wheeler owners to have motor insurance. These two-wheeler insurances will help you cover damage expenses in scenarios of sudden mishaps.

Based on the coverage, there are three types of two-wheeler insurance available in India-

So what are the parameters that should be considered while purchasing two-wheeler insurance?

Know about the policy coverage and your requirement

Before choosing a two-wheeler insurance policy, you must know your basic requirement and budget. Comprehensive two-wheeler insurance is considered the best motor policy because it covers third-party damages and own damage covers. Furthermore, one should contemplate daily two-wheeler usage, its expenditures, and other existing liabilities before selecting the proper coverage.

Select the best premium rate

One of the crucial guidelines while choosing a two-wheeler insurance policy is examining the premium amount. Premium is the amount paid to avail of the benefits of the insurance policy. Hence, the amount should come within your budget. The cubic capacity of a two-wheeler determines the insurance premium. So if the cubic capacity is high, the premium amount will also be at a higher rate.

Consider Insurance Declared Value/IDV

Insurance Declared Value denotes the current value of a vehicle. Simply explained, an IDV is a maximum amount an insurance provider will pay you in case of thefts or accidents. However, with time depreciation lowers the IDV. And as a result, the premium rates also get decreased in an insurance plan. Hence, IDV is a significant variable that should be considered when choosing the premium and compensation amount.

Consider Add-on covers

By paying an extra premium, every policy includes add-on covers that enhance the coverage of your two-wheeler insurance plan. Therefore, one should compare different add-ons available while purchasing a two-wheeler insurance policy. Each insurer provides separate add-on covers. Hence, a two-wheeler owner should opt for an appropriate add-on cover required for the vehicle. Otherwise, the entire insurance plan will be useless.

Conclusion

To make an easy and informed decision, we have compiled the best available two-wheeler insurance plans in a single place. Check out our Insurance page for more details.